In today's digital age, it has become easier than ever to complete various administrative tasks online. One such important task that many individuals need to fulfill is obtaining a NPWP (Nomor Pokok Wajib Pajak) or Tax Identification Number in Indonesia. Whether you are a full-time employee, a self-employed professional, or a business owner, having an NPWP is crucial for fulfilling your tax obligations and maintaining compliance with the Indonesian tax regulations.

In this article, we will explore the process of obtaining an NPWP both online and offline and discuss the requirements and steps involved. So, if you are ready to embark on a journey to understand the intricacies of NPWP registration, let's dive in!

Table of Contents

- Online NPWP Registration

- Offline NPWP Registration

- Requirements for NPWP Registration

- Steps to Obtain NPWP

Online NPWP Registration

If you prefer the convenience of completing administrative tasks from the comfort of your own home or office, online registration for NPWP is the ideal option for you. The online registration process is straightforward and can be completed in a few simple steps. Let's take a closer look at how you can obtain your NPWP online:

Step 1: Visit the Official Tax Office Website

The first step in the online NPWP registration process is to visit the official website of the Tax Office in Indonesia. Ensure that you are accessing the correct website to avoid any potential scams or fraudulent activities. The official tax office website will provide you with the necessary information and guidance for NPWP registration.

Step 2: Gather Required Documents and Information

Before you start the online registration process, it is important to gather all the necessary documents and information. This includes your personal identification documents such as your KTP (Kartu Tanda Penduduk), passport, or other valid identification documents. Additionally, you will need your taxpayer identification number, bank account details, and proof of address.

Step 3: Fill Out the Online Application Form

Once you have all the required documents and information, you can proceed to fill out the online application form. This form will require you to enter your personal details, taxpayer identification number, bank account details, and other relevant information. Ensure that you provide accurate and up-to-date information to avoid any complications during the registration process.

Step 4: Submit the Application and Await Confirmation

After filling out the online application form, you can submit the form electronically through the official tax office website. Once your application is submitted, you will receive a confirmation message indicating that your application has been received and is being processed. The confirmation message may include an application reference number for future correspondence.

Offline NPWP Registration

If you prefer a more traditional approach or are unable to access the internet, you can opt for offline NPWP registration. Offline registration involves visiting your local tax office or authorized service providers to complete the registration process. Although offline registration requires physical presence, the process is relatively straightforward. Let's explore how you can register for NPWP offline:

Step 1: Locate Your Nearest Tax Office

The first step in offline NPWP registration is to locate your nearest tax office. You can do this by visiting the official website of the Tax Office in Indonesia or contacting the customer service helpline. Ensure that you have the necessary contact details and address of the tax office to avoid any inconvenience.

Step 2: Prepare Required Documents

Before visiting the tax office, make sure to prepare all the required documents. These documents include your personal identification documents, taxpayer identification number, bank account details, and proof of address. It is advisable to make copies of these documents to facilitate the registration process.

Step 3: Visit the Tax Office

Once you have gathered all the necessary documents, visit the tax office during working hours. You may need to book an appointment or follow the designated queue system upon your arrival. At the tax office, submit your application form along with the necessary documents to the designated officer.

Step 4: Await Approval and Receive Your NPWP

After submitting your application, you will need to wait for the tax office to process and approve your application. The processing time may vary depending on the workload and efficiency of the tax office. Upon approval, you will receive your NPWP along with any additional instructions or requirements.

Requirements for NPWP Registration

Whether you choose to register for NPWP online or offline, there are certain requirements that you need to fulfill. These requirements ensure that you meet the eligibility criteria for obtaining an NPWP in Indonesia. Let's take a look at the key requirements:

| Requirement | Description |

|---|---|

| Personal Identification Documents | You need to provide valid personal identification documents such as KTP, passport, or other government-issued identification documents. |

| Taxpayer Identification Number | If you have been assigned a taxpayer identification number in the past, you need to provide the number during the registration process. |

| Bank Account Details | It is essential to have an active bank account in your name to facilitate tax-related transactions and refunds. |

| Proof of Address | You may be required to provide a proof of address, such as utility bills or rental agreements, to verify your residential or business address. |

Additionally, it is important to note that the eligibility criteria and requirements may vary for different categories of applicants, such as individuals, self-employed professionals, and businesses. It is advisable to consult the official tax office website or seek professional advice to ensure that you fulfill all the necessary requirements.

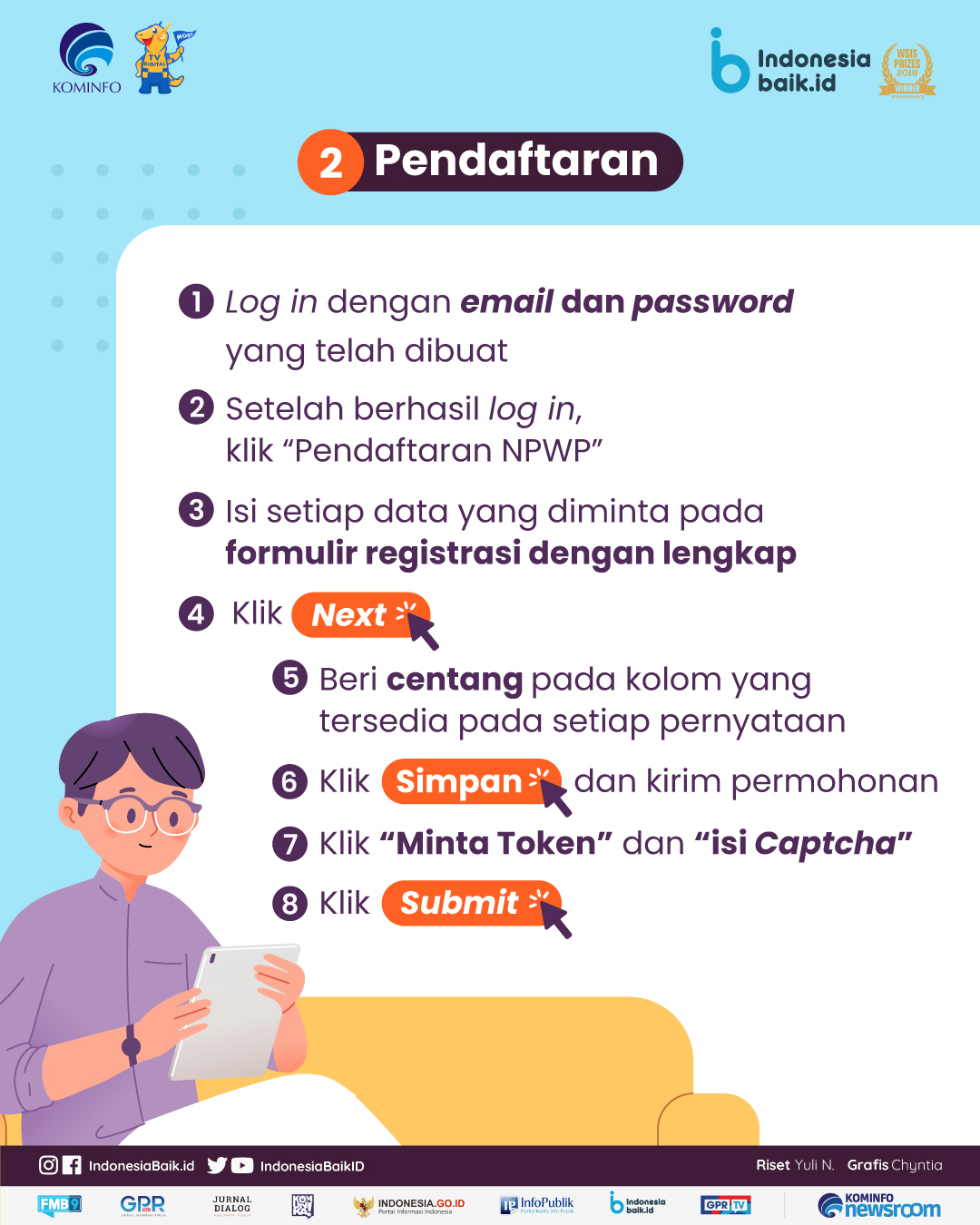

Steps to Obtain NPWP

Regardless of whether you choose online or offline registration, the steps involved in obtaining an NPWP are quite similar. Let's summarize the key steps to help you understand the overall process:

- Visit the official tax office website or locate your nearest tax office.

- Gather all the required documents and information.

- Fill out the application form with accurate and up-to-date information.

- Submit the application online or in person.

- Await confirmation or approval from the tax office.

- Receive your NPWP along with any additional instructions or requirements.

It is important to note that obtaining an NPWP is not a one-time process. Once you have your NPWP, you need to fulfill your tax obligations by filing regular tax returns, paying taxes on time, and keeping your tax records up-to-date. Non-compliance with the tax regulations can result in penalties and legal consequences, so it is essential to stay informed and fulfill your responsibilities as a taxpayer.

In conclusion, whether you choose to register for NPWP online or offline, obtaining a Tax Identification Number in Indonesia is a crucial step in fulfilling your tax obligations. The online registration process offers convenience and ease of access, while the offline registration process allows for a more traditional approach. By following the necessary requirements and steps outlined in this article, you can successfully obtain your NPWP and embark on a journey of responsible tax compliance.