Table of Contents

1. Apa Itu NPWP? Inilah Pengertian dan Panduan Lengkap Tentang NPWP

2. Pendaftaran NPWP Online Mudah Tanpa Ribet Aksoro

3. Cek NPWP Aktif atau Tidak Panduan Mudah untuk Memeriksa Kepemilikan

4. Segera Urus NPWP Kamu atau Tidak Akan Bisa Mengajukan Kredit ke Bank

The National Taxpayer Identification Number (NPWP), or in Indonesian: Nomor Pokok Wajib Pajak, is a unique identification number issued by the Indonesian tax authority to individuals and entities for tax purposes. This article aims to provide a comprehensive guide on what NPWP is, how to register for it online, how to check its validity, and emphasize the importance of having an active NPWP when applying for credit from banks.

1. Apa Itu NPWP? Inilah Pengertian dan Panduan Lengkap Tentang NPWP

NPWP is a unique identification number assigned to individuals and entities in Indonesia for tax compliance. It serves as a means for the tax authority to track and monitor taxpayers' financial activities, ensuring that they fulfill their tax obligations.

Having an NPWP is mandatory for individuals who meet certain criteria, such as having an income above a certain threshold or conducting business activities. Legal entities, including companies and organizations, are also required to have an NPWP.

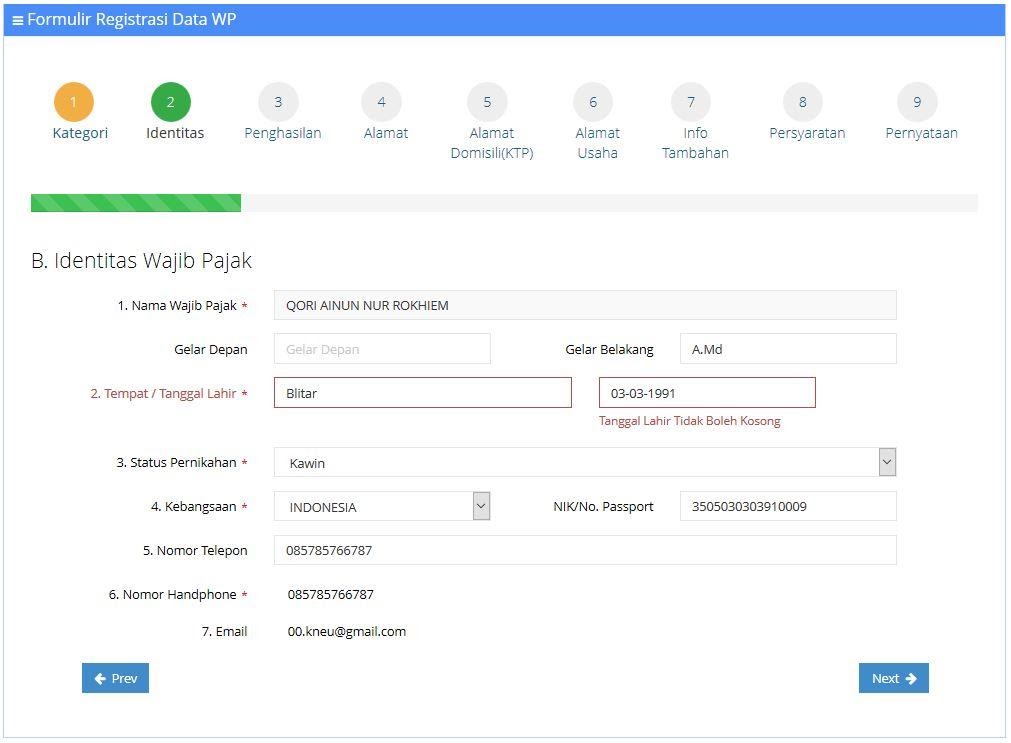

When applying for an NPWP, individuals and entities need to provide relevant personal and business information, including their full name, address, identification number, and other supporting documents. The registration process can be done online through the tax authority's official website or through authorized tax consultants.

2. Pendaftaran NPWP Online Mudah Tanpa Ribet Aksoro

For individuals and entities looking to register for NPWP in an easy and hassle-free manner, Aksoro offers online registration services. Aksoro is a reputable tax consulting firm that specializes in assisting taxpayers with various tax-related matters.

Aksoro's online registration service simplifies the NPWP registration process by guiding users through the necessary steps and providing all the required information and documents. This eliminates the need for individuals and entities to navigate the tax authority's website independently and ensures that all the necessary information is provided correctly.

By using Aksoro's online NPWP registration service, individuals and entities can save time and effort while ensuring compliance with tax regulations. The knowledgeable consultants at Aksoro are available to answer any questions and provide guidance throughout the registration process.

3. Cek NPWP Aktif atau Tidak Panduan Mudah untuk Memeriksa Kepemilikan

It is essential for individuals and entities to periodically check the validity and ownership of their NPWP to ensure that it is active and up to date. This can be done through a simple and straightforward process provided by the tax authority.

The tax authority offers an online verification system where individuals and entities can enter their NPWP details to check its validity and ownership. By entering the NPWP number and the accompanying security code, users can instantly verify whether the NPWP is active and registered under the correct name.

This verification process is crucial for individuals and entities to confirm that their NPWP is still valid and properly registered. It also helps prevent any potential issues that may arise due to discrepancies in the NPWP information.

4. Segera Urus NPWP Kamu atau Tidak Akan Bisa Mengajukan Kredit ke Bank

Having an active NPWP is not only important for tax compliance purposes but also for individuals and entities who wish to apply for credit from banks. Most banks require applicants to provide a valid NPWP as part of the documentation process.

When applying for credit, such as loans or credit cards, banks often request proof of income and tax compliance. An active NPWP serves as proof that the individual or entity has fulfilled their tax obligations and has a legitimate source of income.

Without a valid NPWP, individuals and entities may face difficulties when trying to obtain credit from banks. It can significantly impact their chances of approval and may even result in their credit applications being rejected outright.

Therefore, it is crucial for individuals and entities to ensure that they have an active and properly registered NPWP to maintain compliance with tax regulations and avoid any hindrance in their financial activities.

In conclusion, the NPWP is a unique identification number issued by the Indonesian tax authority for tax compliance purposes. It is mandatory for individuals and entities who meet certain criteria and is essential for various financial transactions, including applying for credit from banks. By understanding the importance of having an active NPWP, individuals and entities can ensure compliance with tax regulations and streamline their financial activities.